Consensus, Rent, and "Affordable Housing"

Madison passed common-sense zoning ordinances whether or not Paul Fanlund agrees. Can we continue this momentum to make a better renting environment?

Last month I wrote about the Housing Forward proposals put forward by Mayor Rhodes-Conway and many alders.

In so many words, I talked about how Paul Fanlund vehemently disagrees with housing reform, doesn’t like how a pro-housing faction won the last election, and denies that Madisonians want to be able to build because his friends privately disagree with that sentiment.

The great thing about Common Council is that citizens get the opportunity to register and provide public comment on agenda items. Everyone gets three minutes (if desired) and they can talk about the item that is being proposed. I showed up on the Tuesday night meeting, spoke in support of all three items, and listened to all other speakers convey the same level of support. There wasn’t a single dissent.

Then the proposals went to a vote. And all three were passed unanimously. It’s possible that “the intimidation factor is real” and people don’t want to speak out in public against these proposals1. But you can still register in opposition and not have the reasoning spelled out in the public comment. What did the registrant support/opposition total look like?

That’s a lot of goose eggs! Which is why the framing in this opinion piece is so infuriating:

The building boom is still unable to keep up with Madison's steady growth, a major reason why the city has pushed controversial zoning changes to allow duplexes in all residential areas of Madison and allow homeowners with deep backyards to split that lot in two and build a second housing unit.

In what way was there controversy?! I get that some people at the Cap Times do not agree with these proposals, but you cannot manufacturer controversy out of a collection of yes votes. There wasn’t a single recorded act of contention. Sure, sure, “silent majority” and all but again that’s not what we saw in April!

You know what is controversial? The Madison Lakeway project that was discussed at this same meeting, took at least three times the amount of public comment, and was the story covered by the Cap Times when recapping Common Council events. That was the controversy of the day that made it into the paper. It speaks volumes that the Lakeway project was the centerpiece of the article and the housing reform didn't get a single mention. That being said…

How is the rent in Madison?

Zweifel is right to bring up the RentCafé Best Cities for Renters 2025, which puts Madison down at 80th overall this year. Madison ranked 70th in 2022, 56th in 2023, and 68th in 2024. We are probably never going to rank high on this list without extensive housing reform because of the survey methodology. You can find the 2025 results and methodolgy explanation here, but the short explanation is:

Housing & cost of living (50% weight)

Local economy (30% weight)

Quality of life (20% weight)

Madison has not been lower than 80th on the list for “Housing and Cost of Living” and most of that comes from housing2. We have been building, but we still aren’t building enough. Professor Kurt Paulsen was able to show Madison “underbuilt” over 11,000 units of housing between 2006-2021 because we added that many more households than housing units. The City is aiming to build 15,000 units from now to 2030. That challenging goal will still likely put us behind what we need, because 4,000 units likely doesn’t characterize the demand for housing in Madison between 2021 and 2030 and we still need to resolve the existing 11,000 home shortage.

There is data we can look to to show us what current demand looks like and it comes from my favorite report on Madison housing: the Madison Housing Snapshot. For now, I will be referencing the 2023 report but we should see a 2025 update sometime this year.

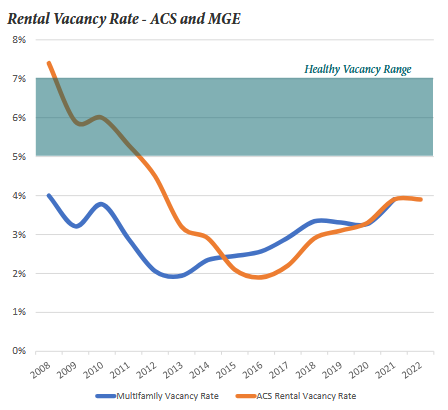

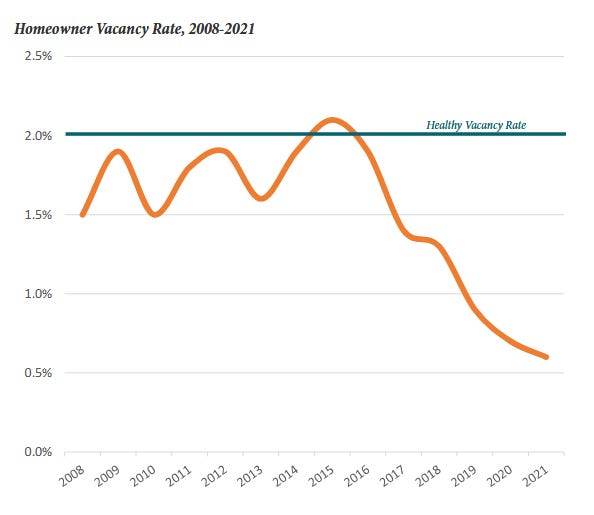

Vacancy rate is a metric that helps demonstrate the fluidity of a housing market. It takes the number of unoccupied homes in an area and divides it by the total number of homes in a city. A healthy vacancy rate for renters is between 5-7%. Anything below 5% is likely a market in shortage, anything above 10% is likely a market in excess (and probably population decline). This report highlights renter vacancy and owner-occupancy vacancy.

As you can see, Madison doesn't fair well for either group. Vacancy is hovering close to 4% for renters and 0.5% for owners; there aren't enough available units to help with turnover and fluidity. Rents and prices are pushed higher and everyone but the incumbent owners3 pay the price.

This is the major driver for our poor rating on RentCafé. Even though you can count the cranes near Downtown, the demand to live here exceeds what we are currently building.

What are we building and does it matter?

Zweifel mentions the “high-end” build rate and how Madison year-over-year saw an increase in expensive housing (39% to 43%). This can be seen in places like Baker’s Place or Oliv; big buildings with pools, saunas, and wellness experts. Do we people really need these amenities? Why can't we just build normal apartments?

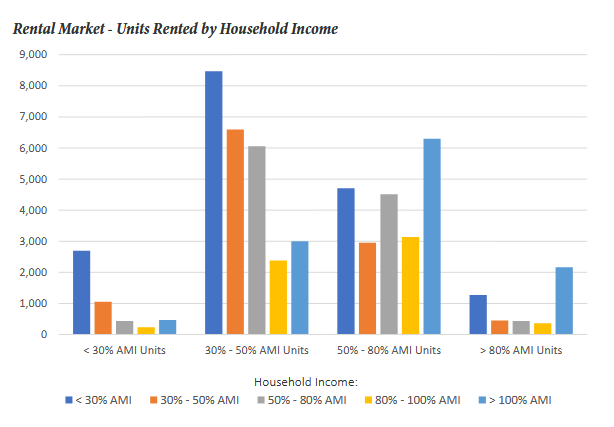

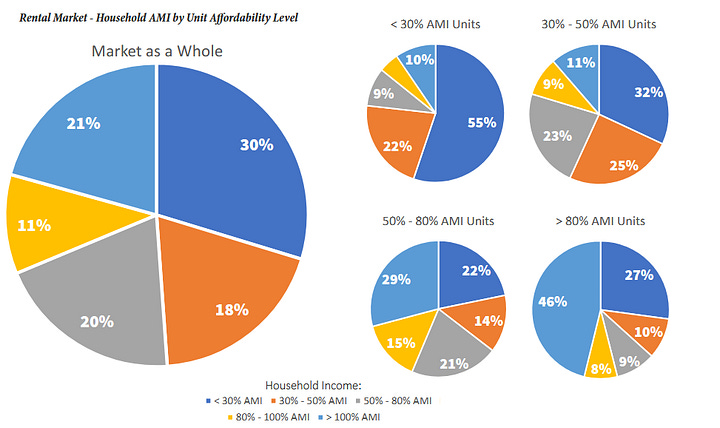

I can't answer those questions beyond “someone is willing to pay for them” and “someone has to be willing to pay for them”. What I can do is highlight who makes up the renter population in Madison and how that determines what we build. My favorite graph from the Housing Snapshot Report:

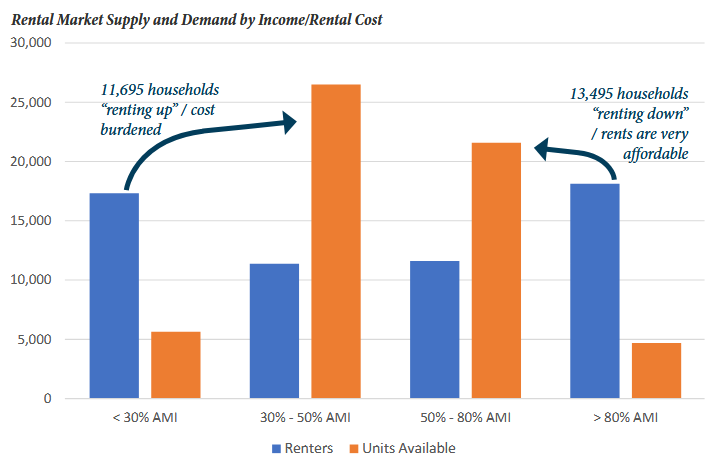

Madison has a horseshoe renting population. Low-income and high-income renters both want to live here and middle-incomes make up less of the population despite the majority of the units that can be afforded. We can define two problems the City should try and solve: not enough low-income housing for renters that can only afford lower rents and not enough high-income housing for renters that can afford higher rents. These “high-end” apartments that we've built target all the renters on the right who may be currently “renting down” into inexpensive housing. For a clearer picture of this scenario, see the following:

We can see that the light blue bars (representing AMI and up earners) are renting at substantial levels in the 30-50% and 50-80% AMI units. Because housing is mostly a private market place, for a person with a $1,200/month budget and a person with a $1,600/month budget, the rent going for $1,300/month always goes to the higher income renter because they can afford it in the first place even though it's a $300/month discount. If we move more of these renters *out* of inexpensive housing into housing that matches their budget, the more opportunities there are to make inexpensive housing available to others. This is called filtering, and in my own personal experience it works. Given an option between $1,200/month and $1,800/month on a $1,600 budget, I picked $1,200/month. These were the two options I had considering timing, the low vacancy, and the area of Madison I needed to live. Two years later, I found a $1,600/month option and I moved out making that room available for someone else.

Additionally, these high-end apartments Downtown are worth their weight in gold for property taxes. Some of the condos and apartments generate over $1 million/acre in taxes for the City. These are funds that can be directed towards true “affordable housing” initiatives with the right budget goals at Common Council.

What is “affordable housing”?

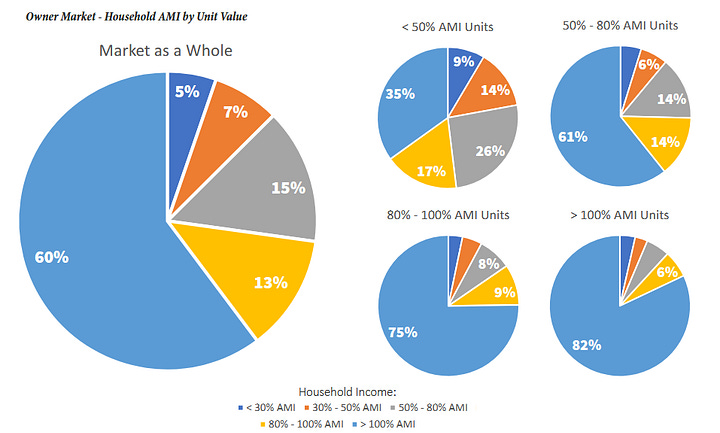

I've attended many public meetings for proposed apartments. Often there's a refrain from neighbors that “we don't need more cookie-cutter, cube-shaped apartment buildings for all the yuppies. What we really need is affordable housing, and that's all I'm going to support.” Affordability is defined by their own life experience and is bracketed by how annoying any new neighbors are going to be. It's too subjective and doesn't really help a city when attempting to create more of it. Most housing is privately funded and therefore is priced at market rates. Market rates aren't going to be “affordable” for people making significantly low incomes. In fact, we can see that in the home ownership data from the snapshot report:

We can try and slow the rapid increase in mean/median housing price or rents in Madison, but ultimately someone is going to have to step in and subsidize the cost of housing directly for those who can't afford it. You can subsidize with vouchers, tax credits, favorable loans, rent control, and other mechanisms. I prefer to use Darrell Owen’s definition of “affordable housing” compared to the subjective idea that people conjure up at neighborhood meetings.

One of those mechanisms is building the housing itself. This is “affordable housing” in its truest sense as the government has constructed a home and rents or sells it at a rate below market value. The difference is paid/subsidized by the tax base. I think this is a good idea. We've built our neighborhoods through income and housing-form exclusivity that stratifies everything from schools to infrastructure. By building affordable housing within existing neighborhoods, we make it so people in different income brackets can form strong communities. Without affordable housing, the low-income homes would not be built.

At the same time, housing is expensive and is in demand here. The City should be doing everything it can to lower costs for projects it designs while delivering more of them. What can the City do better?

Is Theresa Terrace a success?

On July 28th the Mayor, Alder Harrington-McKinney, and several stakeholders in the Theresa Terrace Affordable Housing project performed a ribbon cutting ceremony to celebrate construction completion. The City helped design and finance the demolition of two obsolete duplexes into six attached townhomes that will be made permanently affordable to Madisonians making 60% or less of the area median income. This infill housing excites me and I think this should be legal in all residential areas (it isn't currently). It was particularly exciting because the previous duplexes were owned by the Community Development Authority, a branch of Madison city government, implying the potential for a repeatable process with other vacant, City-owned properties.

How reproducible is it? We should understand the costs and timeline for the Theresa Terrace project (from the Madison is for People August 2025 Newsletter):4

Timeline

Existing duplexes owned by the Community Development Authority (CDA) are vacant for several years, consisting of significant mold damage that prevent reuse, and deemed functionally obsolete (likely 2017 and on)

CDA proposes transferring ownership to the Madison Revitalization and Community Development Corporation (MRCDC, a subsidiary of the CDA) to redevelop the lots and expand the number of units on site. The financing will use a Section 8 platform and rent-to-own Section 8 Homeownership program to house Madisonians making no more than 60% AMI. The first pre-application meeting takes place on 2/1/2022 with follow-up community meetings on 11/7/2022 and 11/21/2022

The CDA applies and receives a demo permit on 1/23/2023 to demolish the existing duplexes

The CDA applies and receives a zoning ordinance change on 2/7/2023 to rezone the properties at 1309-1311 and 1401-1403 Theresa Terrace from SR-C3 (which does not permit single-family attached dwellings of 3-4 units) to SR-V1 (which does allow by right)

Common Council authorizes up to $2 million to MRCDC for the demolition and reconstruction of the property to six new affordable units on 12/5/2023

MRCDC receives no responses for the construction bid by 10/23/2023 and moves forward with an all-inclusive bid of $2.73 million with KPH Construction on 5/9/2024

Common Council authorizes an additional $1 million in General Fund-supported GO Borrowing to finance the construction and cover the funding gap on 5/21/2024. This is a loan to MRCDC that will be repaid

KPH breaks ground on the project on 9/17/2024

CDA approves the additional $1 million GO financing to ensure the project is complete in 2025 on 4/14/2025 (a procedural step to disburse the financing)

A ribbon-cutting ceremony takes place on 7/28/2025

Residents move in to the home: TBD

Without looking into other projects the CDA has or is developing, I am now establishing Theresa Terrace as the new affordable housing baseline.

*The baseline is $455,000/unit in 3.5 years*

We need to do better than this. The average home in Madison is $430,000. Design and construction shouldn’t take 3.5 years. Those are the two variables we should be looking to decrease.

Borrowing again from myself, here are some questions I hope we as a City as answer:

How many buildings are currently under CDA ownership and could be redeveloped into more homes? How many of these are vacant and could be redeveloped within 5 years?

How long does it take to design new homes in a neighborhood? Are these plans reproducible in other areas of Madison? How many adjustments would be needed? Should we have template designs that the CDA can pull from to ease the design burden?

How long does it take to move from design to demo and zoning permits? For this project, it took approximately 1 year (2/1/2022 initial pre-application meeting, 2/7/2023 for rezoning) to complete that process. Is there anything that can make this process go faster?

How do we increase funds that the CDA can use to build housing? How do we ensure those funds can be used in a timely manner? For this project, it took a little less than 1.5 years to get all funding (2/7/2023 likely starts process for bid, 10/23/2023 goes by with no bid, 12/5/2023 is first allotment and 5/9/2024 is full allotment)

What would it take to get more bids for homes in Madison? Is this something that should be bid to a vendor? Should the City be in the business of competing with bids if no vendor can meet initial bid viability?

The funding gap is filled on 5/21/24, but groundbreaking doesn’t take place until 9/17/2024. Can we reduce the amount of time it takes to move from approved permits and funding to construction?

Construction was complete in 10 months, is this typical for construction projects and is there anything that can speed this process?

What risk is associated with building affordable homes and is there something the City can do to reduce risks to encourage more developers?

Tax Increment Financing is a mechanism typically used for large-scale development projects. Could we use small TIF to help boost production of affordable homes?

I’ll quote myself one last time:

Ultimately, I want to see the City take on more of these projects; we need to establish Missing Middle homes and sometimes it takes the government to step in when the private market isn’t willing (yet). But we really should examine closely what worked well, what caused pains or created barriers, and look to remove them so we can build more homes for more people. There are improvements that can be made. The CDA, MRCDC, and other City Staff that helped with this project should be proud of their work and also tenacious about making this more feasible, reproducible, and expandable in other neighborhoods in Madison.

It’s fair to note that Madison’s not an affordable city. I don’t think it’s fair to point to recent zoning changes and say “as more renters are priced out of the market despite the proliferation of new complexes” without having real time to let it play out. I know a lot of our attention spans are kaput nowadays, but this stuff takes time. We can (mostly) control the number of apartment buildings that are built. We can control the rules that affordable housing projects have to follow. We should work the system to make it favorable to make both more likely.

Feasible, reproducible, expandable. Across Madison. That’s the goal and let’s make it a standard.

I doubt it

As far as I can tell. Most of the weight comes from C2ER COLI and I’m not paying for that yet. But sites that seem to link back to it put housing costs at 8% higher than average and everything else below average. Housing drives our costs.

Even incumbents pay a price though. 1) there are less people to pay property taxes (70% of Madison revenue) and 2) if they move out of their home, finding one within Madison is pricier (common for seniors downsizing from the family home)

I’m borrowing this timeline, but I wrote it so *shrug*